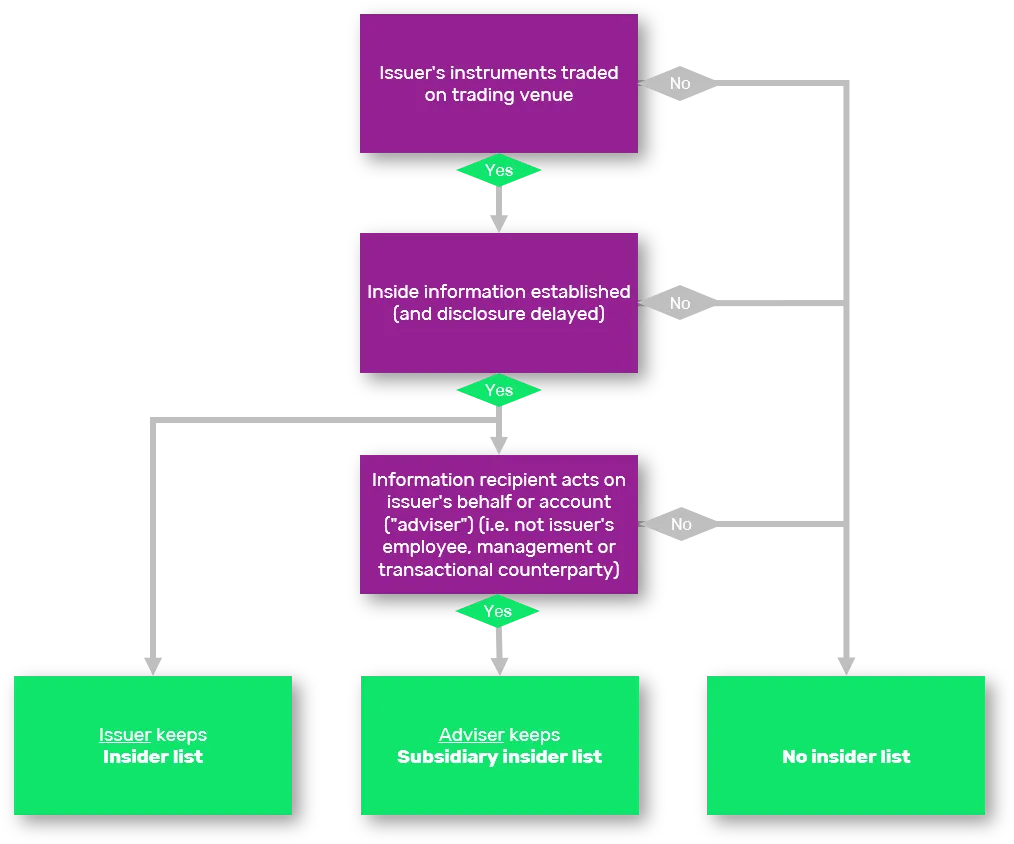

Know when you as an adviser need to create your own insider list (“sub list”)

Are you supposed to create an insider list or a subsidiary insider list? Follow the arrows to find out.

Or if you haven´t read our other guides yet. Please feel free to follow the links below.

Learn more about subsidiary insider lists

Learn more about obligations concerning transactional counterparties and market soundings

Information compiled from https://www.esma.europa.eu/

The Essential Guide to Writing and Enforcing a Code of Conduct

Every successful organisation needs a strong code of conduct to set the tone for ethical behaviour and guide employees in their daily decisions. A well-crafted code of conduct isn’t just a document […]

The Essential Guide to Writing and Enforcing a Code of Conduct

Every successful organisation needs a strong code of conduct to set the tone for ethical behaviour and guide employees in their daily decisions. A well-crafted code of conduct isn’t just a document […]

Code of Conduct vs. Code of Ethics: What’s the Difference and Why It Matters

When organisations embark on creating policies for ethical conduct, two terms often emerge: code of conduct and code of ethics. These phrases are sometimes used interchangeably, which can cause confusion. In this […]

Conflict of Interest Explained: Types, Policies, and Real Examples

Conflicts of interest are a common yet potentially serious issue in organisations of all sizes. Whether you’re running a small business or managing a large corporation, you need to be aware of […]

Board of Directors Conflict of Interest: Compliance Best Practices

Conflicts of interest at the board of directors level pose unique challenges. Board members hold significant decision-making power and fiduciary duties, yet they often have broad networks, business interests, or roles in […]